In a significant development for the housing market, mortgage rates in the United States have fallen to their lowest levels in over two years. This comes as the Federal Reserve is widely expected to announce a rate cut in the coming weeks, further fueling optimism for prospective homebuyers and homeowners looking to refinance. With US Mortgage Rates at historic lows, many are wondering what this means for the housing market, the broader economy, and, most importantly, for their personal finances.

In this blog, we’ll dive into what’s driving the recent drop in mortgage rates, how a Federal Reserve rate cut could impact those rates further, and what this all means for current homeowners, potential homebuyers, and the overall economy.

What’s Behind the Drop in Mortgage Rates?

Mortgage rates are influenced by a variety of factors, including the overall economic outlook, inflation expectations, bond yields, and monetary policy decisions. Recently, a combination of these factors has contributed to the significant decline in rates.

- Economic Uncertainty: The global economy has been facing a number of challenges, from trade tensions to slowing growth in key markets like Europe and China. This has led to increased demand for safe-haven assets like U.S. Treasury bonds, which tend to drive down yields. Since mortgage rates are closely tied to the 10-year Treasury yield, this has resulted in lower rates for home loans.

- Inflation Remains Low: Inflation expectations have remained subdued, meaning that the Federal Reserve has more room to keep interest rates lower without the risk of overheating the economy. Low inflation keeps borrowing costs down across the board, including mortgage rates.

- Anticipation of a Fed Rate Cut: Investors and economists alike are widely expecting the Federal Reserve to cut its benchmark interest rate in the coming weeks. The Fed’s rate directly influences short-term borrowing costs but also has a significant impact on long-term rates, including mortgages. The anticipation of a rate cut has already contributed to the recent drop in mortgage rates.

- Bond Market Movements: With bond yields hitting lows not seen in years, lenders are adjusting mortgage rates accordingly. The 10-year Treasury bond is often used as a benchmark for mortgage rates, and as those yields drop, so do mortgage rates.

How Low Are Mortgage Rates Now?

As of the latest data, the average 30-year fixed-rate mortgage is hovering around 3.5%, the lowest level seen since mid-2017. This represents a significant drop from just a year ago when rates were closer to 4.5%. For comparison, just two years ago, rates were nearing 5%, so this recent decline is a notable improvement for borrowers.

15-year fixed-rate mortgages, which are popular with homeowners looking to refinance, have also dropped to around 3%, making refinancing an even more attractive option for many.

How a Fed Rate Cut Could Impact Mortgage Rates Further

The Federal Reserve’s decision to cut interest rates has been widely expected as a way to counteract economic uncertainty and prevent a potential recession. While the Fed’s rate cut would directly affect short-term interest rates, it also tends to have a ripple effect on long-term rates like mortgages.

If the Fed proceeds with the expected rate cut, we could see mortgage rates drop even further. Here’s how it works:

- Fed Rate vs. Mortgage Rates: While the Federal Reserve does not directly control mortgage rates, its benchmark rate influences borrowing costs across the economy. When the Fed cuts rates, it generally signals that borrowing will become cheaper, which can lead to a drop in mortgage rates.

- Market Sentiment: Rate cuts are often seen as a sign that the central bank is taking proactive steps to ensure economic stability. This can boost confidence in the bond market, driving down yields and further reducing mortgage rates.

- Homebuyers’ Confidence: Lower interest rates generally encourage more borrowing, as the cost of financing a home becomes more affordable. This could lead to increased demand in the housing market, potentially driving up home prices in certain regions.

What Does This Mean for Homebuyers?

For prospective homebuyers, the current drop in mortgage rates represents a prime opportunity to lock in a low interest rate on a new home loan. Lower rates mean lower monthly payments, which can make it easier to afford a home or allow buyers to purchase a more expensive property than they might have been able to with higher rates.

Additionally, a Fed rate cut could provide even more savings for those who have yet to finalize their home loans. If rates continue to decline, buyers who have been on the fence about entering the market may find this to be the ideal time to make a move.

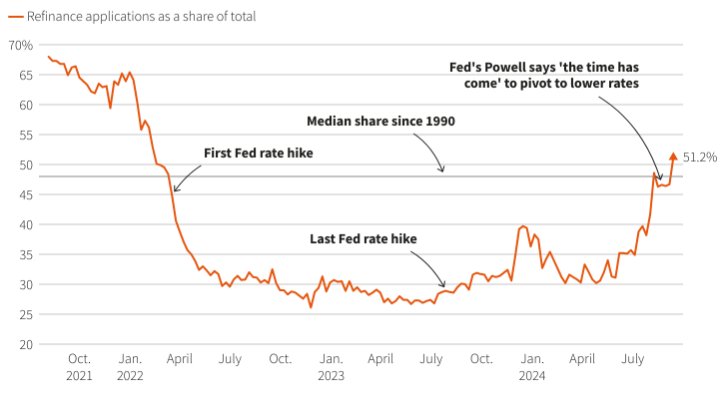

Is Now a Good Time to Refinance?

For current homeowners, the drop in mortgage rates presents a golden opportunity to refinance existing home loans. Refinancing at a lower interest rate can significantly reduce monthly mortgage payments, save thousands of dollars in interest over the life of the loan, and, in some cases, allow homeowners to tap into home equity for home improvements or other expenses.

If your current mortgage rate is higher than the prevailing rates, now may be a good time to explore your refinancing options. Keep in mind that refinancing does come with costs, such as closing fees, so it’s important to weigh the potential savings against these expenses to determine if it makes financial sense for you.

The Broader Economic Impact

The housing market plays a critical role in the overall U.S. economy, and changes in mortgage rates can have ripple effects throughout various sectors. Lower mortgage rates typically lead to increased home buying activity, which in turn stimulates the construction, real estate, and financial industries. This can lead to job creation, higher consumer spending, and a boost to local economies.

However, there are also potential downsides to consider. While lower rates may drive up demand for housing, it could also exacerbate the ongoing issue of housing affordability in some markets. With more buyers competing for a limited supply of homes, prices could continue to rise, particularly in high-demand areas. This could make it more difficult for first-time buyers to enter the market, even with lower interest rates.

Final Thoughts

The recent drop in U.S. mortgage rates to a two-year low, combined with the expectation of a Federal Reserve rate cut, presents a unique opportunity for both homebuyers and homeowners alike. Whether you’re looking to purchase a new home or refinance an existing mortgage, now may be the perfect time to take advantage of historically low rates.

However, as with any major financial decision, it’s important to do your research, consult with a mortgage professional, and carefully consider your individual financial situation before making any moves. While lower mortgage rates can lead to significant savings, it’s essential to ensure that you’re making the right decision for your long-term financial goals.